What is Cash Value Life Insurance? A Complete Guide for 2025

Introduction to Cash Value Life Insurance

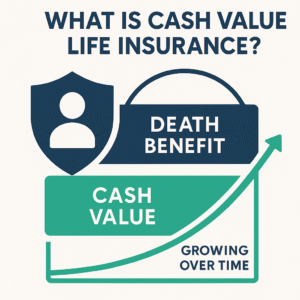

Cash value life insurance is a type of permanent life insurance that not only provides a death benefit but also accumulates a savings component known as “cash value.” This dual benefit makes it an attractive option for individuals looking to combine long-term financial protection with wealth accumulation.

Unlike term life insurance, which offers coverage for a specific period, cash value life insurance remains active as long as premiums are paid. Over time, the policy builds a cash reserve that can be used for loans, withdrawals, or even to pay premiums.

In this comprehensive guide, we will explore everything you need to know about cash value life insurance, including how it works, its types, benefits, drawbacks, and whether it’s the right choice for you.

Understanding the Basics of Life Insurance

Before diving into the concept of cash value, it’s essential to understand the fundamentals of life insurance.

Life insurance is a contract between the policyholder and the insurance company. In exchange for regular premium payments, the insurer promises to pay a death benefit to the beneficiaries upon the insured’s death.

Types of Life Insurance

Term Life Insurance – Coverage for a specific period (e.g., 10, 20, 30 years)

Permanent Life Insurance – Lifetime coverage with cash value accumulation

What is Cash Value in Life Insurance?

Cash value is the savings portion of certain permanent life insurance policies. A portion of your premium goes into this account, which grows over time on a tax-deferred basis.

How It Works

Each premium payment is divided into three parts:

Cost of Insurance – To cover the death benefit

Administrative Fees – For policy management

Cash Value Contribution – Invested or stored by the insurer for growth

The cash value accumulates interest or returns depending on the type of policy and can be accessed by the policyholder in several ways.

How Does Cash Value Life Insurance Work?

The policyholder pays regular premiums. A portion of those premiums builds up the cash value, which grows at a guaranteed or variable rate depending on the type of policy.

As the policy matures:

The death benefit remains constant (or may increase in some cases)

The cash value increases over time

The policyholder can borrow against or withdraw from the cash value

Types of Cash Value Life Insurance Policies

There are several types of policies that offer cash value features:

1. Whole Life Insurance

Offers guaranteed death benefit and fixed premiums

Cash value grows at a guaranteed rate

Often includes dividends (in participating policies)

2. Universal Life Insurance

Flexible premiums and death benefit

Interest credited to cash value at a market-based rate

Adjustable components make it more customizable

3. Variable Life Insurance

Investment-focused policy

Cash value is invested in sub-accounts (like mutual funds)

Potential for high returns, but also higher risk

4. Indexed Universal Life Insurance (IUL)

Tied to stock market indices like S&P 500

Upside potential with downside protection

Ideal for those seeking growth with some stability

Cash Value vs Term Life Insurance

| Feature | Cash Value Life Insurance | Term Life Insurance |

|---|---|---|

| Duration | Lifetime | Specific Term (10–30 years) |

| Premiums | Higher | Lower |

| Cash Value | Yes | No |

| Flexibility | High (in universal/variable) | Low |

| Cost | Expensive | Affordable |

| Investment Component | Yes | No |

How Cash Value Grows Over Time

The growth of cash value depends on:

The type of policy

The insurer’s performance

Interest rate (guaranteed or indexed)

Dividends (if applicable)

In early years, most of your premium goes toward administrative fees and cost of insurance. After a few years, the growth starts to accelerate.

Benefits of Cash Value Life Insurance

1. Lifetime Coverage

Once approved, you remain covered for life, provided premiums are paid.

2. Savings and Investment

Your premiums help build a cash reserve which earns interest or returns.

3. Tax Advantages

Cash value grows tax-deferred, and policy loans are generally not taxable.

4. Emergency Funds

You can borrow against the cash value for emergencies or major expenses.

5. Supplement Retirement Income

Withdrawals or loans during retirement can act as a source of supplemental income.

Who Should Consider Cash Value Life Insurance?

Cash value life insurance is suitable for:

High-income individuals

People with estate planning needs

Business owners

Those seeking lifelong coverage with savings

Parents wanting to leave a financial legacy

How to Use Cash Value

1. Loans Against Cash Value

You can borrow from the policy and repay later. The interest is typically low, and repayment is flexible.

2. Withdrawals

Withdraw cash directly (may reduce death benefit and could be taxable).

3. Surrendering the Policy

Cancel the policy and receive the surrender value (cash value minus fees).

4. Paying Premiums

Use the accumulated cash value to pay future premiums.

Tax Implications of Cash Value Life Insurance

Growth is Tax-Deferred – No taxes while the cash value grows.

Policy Loans are Not Taxed – If properly managed.

Withdrawals May Be Taxed – If you withdraw more than you paid in premiums.

Death Benefit is Generally Tax-Free – For beneficiaries.

Common Myths and Misconceptions

Myth: Cash Value Grows Quickly

Reality: It grows slowly in the initial years.Myth: It’s Always Better than Term

Reality: Depends on your goals and budget.Myth: You Can Withdraw Cash Value Anytime Without Impact

Reality: Withdrawals may reduce the death benefit or cause policy to lapse.

How to Choose the Right Cash Value Policy

1. Compare Providers

Research company ratings, history, and policy options.

2. Understand Riders

Look for additional coverage like long-term care, disability waiver, etc.

3. Use a Financial Advisor

A certified planner can help you align the policy with your long-term financial goals.

Best Cash Value Life Insurance Companies in 2025

Northwestern Mutual – Strong dividends and customer service

MassMutual – Reliable whole life policies

New York Life – Great for estate planning

Guardian Life – Offers multiple flexible options

State Farm – Competitive rates and support

Case Studies and Real-Life Examples

Example 1:

A 35-year-old buys a whole life policy for $250/month. After 15 years, he has over $20,000 in cash value and uses a portion to pay off debt.

Example 2:

A small business owner uses a cash value policy as key-man insurance and borrows against it to expand the business.

FAQs About Cash Value Life Insurance

Q1: Can I lose money with cash value life insurance?

Yes, especially with variable policies due to market risk or if the policy lapses.

Q2: How long does it take for cash value to build up?

Typically 5–10 years before seeing significant accumulation.

Q3: Is cash value taxable?

No, unless you withdraw more than what you paid in premiums.

Q4: Can I access the cash value anytime?

Yes, through loans or withdrawals, but with implications.

Final Thoughts: Is Cash Value Life Insurance Right for You?

Cash value life insurance is a powerful financial tool when used properly. It offers the dual benefits of lifelong protection and wealth accumulation. However, it’s not for everyone. If you’re primarily looking for affordable coverage, term insurance may be more suitable.

But if you want lifetime coverage, the ability to build tax-advantaged savings, and the flexibility to borrow or withdraw funds, cash value life insurance could be a smart investment in your future.

Always consult a licensed financial advisor to see how it fits within your overall financial strategy.